Paul Guilfoyle's financial standing, often expressed as net worth, represents the aggregate value of his assets, less any liabilities. This figure encompasses various holdings such as real estate, investments, and personal property. Determining an exact figure requires access to private financial records, and publicly available information may only offer a partial view. Estimates of this financial position can vary, depending on the source and methodologies employed.

Understanding an individual's financial situation, including their assets and debts, provides context for various analyses. This includes assessing career success, financial stability, and the potential impact on decisions, both personal and professional. Understanding the valuation of an individual's assets and obligations is often important when considering their potential influence or role in specific contexts.

Further exploration into this aspect of Paul Guilfoyle's life may require delving into specific areas of his career, personal investments, or public activities. Information on this topic can be found through varied resources including financial publications, news reports, or biographies.

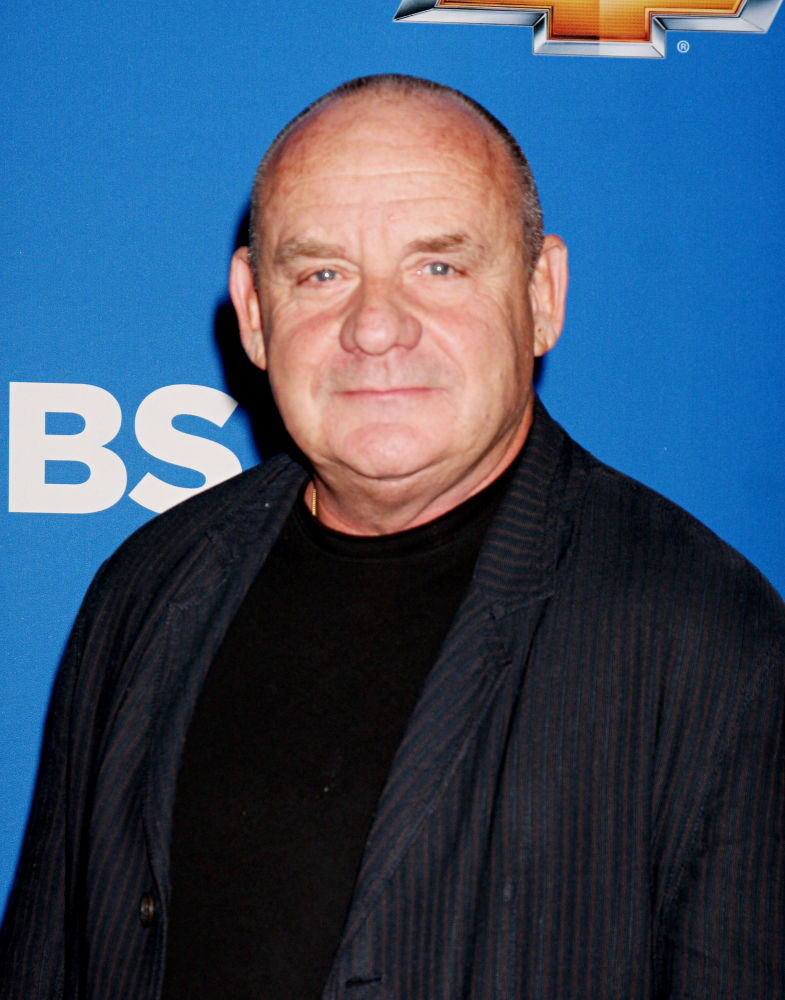

Paul Guilfoyle Net Worth

Understanding Paul Guilfoyle's net worth involves examining various facets of his financial situation. This includes assets, liabilities, and their impact on overall financial standing. The following key aspects provide a framework for analysis.

- Assets

- Liabilities

- Investment strategy

- Income sources

- Financial history

- Valuation methods

- Public perception

- Career impact

These eight aspects, while seemingly disparate, collectively provide a more nuanced understanding of Paul Guilfoyle's financial position. Assets, like property or investments, contribute to net worth. Liabilities, such as debt, reduce net worth. Examining investment strategy illuminates the choices made regarding financial growth and risk tolerance. Income sources reveal avenues of financial gain. A comprehensive financial history traces changes over time. Valuation methods employed, public perception of wealth, and the influence of his career choices all contribute to this complex picture. For instance, a high-earning professional with substantial investments will likely have a higher net worth compared to someone with a lower income and fewer assets.

1. Assets

Assets are crucial components in determining net worth. They represent the ownership of valuable items or resources that hold monetary value. An evaluation of assets forms a substantial part of assessing the financial position of any individual. In the context of Paul Guilfoyle's net worth, a detailed analysis of his assets is necessary to gain a complete picture of his financial standing.

- Real Estate Holdings

Property ownership, including residential homes, commercial buildings, and land, represents a significant portion of an individual's assets. The value of these properties is influenced by factors like location, condition, and market demand. Changes in these factors directly affect the overall asset value. In Paul Guilfoyle's case, the valuation of any real estate holdings would play a critical role in calculating his net worth.

- Investment Portfolios

Investments in stocks, bonds, mutual funds, or other financial instruments constitute a significant portion of an individual's assets. The success of these investments, influenced by market fluctuations and diversification strategies, directly affects the overall worth. The composition and performance of any investment portfolio would significantly influence the estimated net worth of Paul Guilfoyle.

- Personal Assets

Personal assets encompass items like vehicles, jewelry, art collections, or other personal possessions. While often less significant compared to real estate or investments, these items contribute to the overall asset calculation. Their assessed values are factored into the total asset value. In determining Paul Guilfoyle's net worth, the inclusion of personal assets completes a more comprehensive financial picture.

Ultimately, the value of assets is a critical component in evaluating Paul Guilfoyle's net worth. Analyzing different asset classes, considering their current market values, and assessing their potential future returns provide a comprehensive understanding of the individual's overall financial situation.

2. Liabilities

Liabilities represent financial obligations owed by Paul Guilfoyle. Understanding these obligations is essential to a complete picture of his net worth, as they directly subtract from the total value of his assets. A detailed assessment of liabilities provides insight into the financial commitments and potential pressures impacting his overall financial standing.

- Debt Obligations

This encompasses various forms of debt, including loans, mortgages, credit card balances, and outstanding bills. The amount and types of debt directly influence his net worth. High levels of debt can significantly reduce the net worth calculation. For example, large outstanding mortgages on property holdings will lower the overall value, while substantial credit card debt similarly impacts the net worth figures.

- Accrued Expenses

These are expenses that have been incurred but not yet paid. Examples include accrued interest on loans or unpaid taxes. These unpaid amounts reduce the net worth calculation by representing financial obligations due, although perhaps not immediately payable. Unpaid taxes or accrued interest on loans reduce the net worth. These accrued expenses will have to be addressed to avoid further impact on his net worth.

- Contingent Liabilities

These are potential future obligations that may or may not materialize. Examples include pending lawsuits or guarantees on loans. Contingent liabilities represent a potential future financial burden. The likelihood and extent of these potential claims affect their impact on net worth estimations, especially if the obligations are substantial and probable. Potential legal or financial commitments need careful analysis.

- Financial Guarantees and Commitments

These include commitments to others for which financial responsibility might be incurred, even if not an immediate debt. Examples include financial guarantees on contracts or agreements. Guaranties reduce net worth potential and future flexibility. The impact of financial guarantees or commitments needs careful assessment in the overall net worth picture, as they represent potential future obligations.

Analyzing liabilities alongside assets provides a holistic view of Paul Guilfoyle's financial position. The extent and nature of his liabilities can influence his financial capacity and future decision-making. Considering the interplay between assets and liabilities is critical for a thorough understanding of his financial standing.

3. Investment Strategy

Investment strategy profoundly influences an individual's net worth. The choices made regarding investment vehicles, diversification, and risk tolerance directly impact the growth and stability of accumulated wealth. A well-defined and consistently executed strategy fosters financial security and can significantly enhance the overall net worth over time. Conversely, poor or inconsistent investment decisions can erode accumulated wealth and negatively affect net worth.

The success of an investment strategy hinges on various factors, including market conditions, economic cycles, and individual risk tolerance. For example, a strategy prioritizing high-growth stocks during a bull market might yield substantial returns, while a more conservative strategy emphasizing bonds or dividend-paying stocks could provide greater stability during economic downturns. The specific investment strategy employed by an individual will reflect their financial goals, time horizon, and willingness to accept risk. Different approaches to investment strategies can yield vastly different outcomes, thus significantly influencing net worth.

Understanding the connection between investment strategy and net worth is crucial for both individuals and financial advisors. Effective strategies, tailored to specific circumstances and goals, are vital in maximizing returns and preserving capital. The application of sound investment strategies, such as diversification and regular rebalancing, plays a pivotal role in long-term financial security. Ultimately, a strong investment strategy, aligned with an individual's financial objectives, is a key factor in building and maintaining a substantial net worth. A poorly conceived investment strategy can lead to unexpected losses and undermine the growth of net worth. Thorough research and understanding of market trends are imperative for designing a suitable investment strategy.

4. Income Sources

Income sources are fundamental to understanding Paul Guilfoyle's net worth. The volume and stability of income directly influence the accumulation and growth of wealth. Different income streams contribute varying degrees of financial security and potential for future asset accumulation. Analyzing these streams provides critical context for evaluating the overall financial position.

- Employment Income

Salaries, wages, and other compensation from employment are often the primary source of income for individuals. The nature of employment (e.g., industry, position) significantly affects earnings potential. Factors such as experience, skill level, and market demand influence compensation. High-income employment in high-demand fields typically translate to higher net worth potential.

- Investment Income

Earnings derived from investments, such as dividends, interest, or capital gains, contribute to the overall income stream. The return on investments is influenced by market performance and the types of investments made. Stable and consistent investment income can significantly augment overall net worth over time. A diverse and well-managed portfolio of investments provides a supplementary income stream, potentially enhancing net worth.

- Entrepreneurial Income

For entrepreneurs, income is derived from business operations. Profit margins, business structure, and market conditions all play critical roles in determining the level of entrepreneurial income. Successful ventures can generate substantial income, directly impacting net worth. The success of ventures and their associated income streams significantly affect net worth.

- Passive Income Streams

These sources include income generated through investments, real estate rentals, or royalties. These income streams often require initial capital investment and ongoing management. Passive income streams can provide stable, consistent income and increase net worth over time. Such sources of income often play a crucial role in long-term financial stability and growth of net worth.

In summary, the diverse sources of income play a key role in evaluating Paul Guilfoyle's overall financial standing and contribute to the total picture of his net worth. Analyzing income streams reveals crucial insights into the potential for wealth accumulation, stability, and potential future financial security.

5. Financial History

A comprehensive understanding of Paul Guilfoyle's net worth hinges significantly on his financial history. This history provides context for current financial standing, illuminating patterns of income, expenditure, investment behavior, and debt management. It reveals how past choices and circumstances have shaped his current financial position and potential for future growth or challenges. Examining this history helps paint a clearer picture of the factors influencing his current net worth.

- Income Patterns and Trends

Detailed income records over time reveal patterns, fluctuations, and sources of income. For example, sustained growth in income from a specific career or investment avenue can point to a strong foundation for wealth accumulation. Conversely, periods of decreased income or shifts in income sources may signal potential vulnerabilities or adjustments in financial strategy. Tracking these patterns helps forecast potential future income levels, which are vital for evaluating future net worth potential.

- Expenditure Analysis

Expenditure habits offer insights into spending priorities and financial discipline. Consistency in spending habits across various periods demonstrates financial prudence and allows for more accurate predictions of future spending patterns. Analysis of expenses can show areas where spending may be excessive and highlight opportunities for savings or cost-cutting measures, which impacts the overall financial picture and therefore net worth.

- Investment History and Performance

Tracing investment activities over time reveals patterns in risk tolerance, portfolio diversification, and overall investment performance. Data on investment decisions, returns, and adjustments to portfolios can identify successful investment strategies, which often underpin a high net worth. Understanding historical investment outcomes provides insight into the effectiveness of investment decisions and their potential impact on future wealth.

- Debt Management and History

Analysis of borrowing, repayment histories, and management of outstanding debts helps assess financial responsibility and potential liabilities. Consistent repayment of debts demonstrates prudent financial management and suggests a lower risk of financial distress. Conversely, difficulties with debt repayment or accumulation of significant debt may negatively impact net worth and financial stability.

Ultimately, a thorough exploration of Paul Guilfoyle's financial history provides critical data points for estimating and interpreting his net worth. The patterns revealed through this analysis can reveal underlying strengths, weaknesses, and potential risks affecting his overall financial well-being. The data will help in judging his financial health and predict his future financial standing, making it valuable for understanding his net worth contextually.

6. Valuation Methods

Determining Paul Guilfoyle's net worth necessitates employing appropriate valuation methods. These methods provide a framework for assessing the worth of various assets, a crucial element in calculating net worth. The accuracy of the estimated net worth relies heavily on the reliability and appropriateness of the chosen valuation techniques. Different asset types require specific methodologies. For instance, valuing real estate typically involves comparable sales analysis, considering recent transactions of similar properties in the same location. Investment portfolios, composed of stocks, bonds, and other securities, necessitate using market values, which are derived from current trading prices in the respective markets. Personal assets, such as vehicles or collections, often involve expert appraisals, which consider factors like condition, rarity, and market demand.

The choice of valuation method significantly impacts the outcome. Using outdated market data for investments or failing to consider depreciation for real estate can lead to inaccurate estimations. For example, a company's financial statements, often used to assess the value of shares, rely on estimates of future earnings, which are inherently uncertain. Furthermore, the subjectivity inherent in some appraisal methods can introduce variability into the net worth calculation. Therefore, a comprehensive analysis requires a multi-faceted approach, combining various valuation methods and considering potential limitations or biases inherent to each approach. A precise estimation of net worth is a complex calculation, requiring a deep understanding of these valuation principles. Any single methodology risks oversimplification and inaccuracies.

Consequently, understanding the various valuation methods used in assessing assets is crucial for accurately interpreting Paul Guilfoyle's net worth. Recognizing the different approaches employed, their strengths, and limitations allows for a more nuanced understanding of the financial situation. The appropriate selection of valuation methods is fundamental to generating a reliable and comprehensive estimation of net worth, a process demanding meticulous consideration and attention to detail.

7. Public Perception

Public perception of an individual's financial standing, while not a direct component of net worth itself, can significantly influence its perceived value and impact. Public perception, shaped by media portrayals, professional successes, and social interactions, can affect how the public and potentially investors, partners, or others view an individual's worth. A positive public image can elevate the perceived value, potentially even impacting asset valuations or attracting opportunities. Conversely, negative perceptions might depress the market value of assets or limit access to certain opportunities. This connection is not always direct, but it functions as a powerful external force.

Real-world examples illustrate this dynamic. A highly publicized and successful entrepreneur often enjoys a positive public perception, potentially attracting investment or partnership deals. This enhanced perception can even inflate the perceived value of their assets beyond their actual market value. Conversely, a public controversy or negative media coverage can negatively impact the public's perception of an individual's financial standing, potentially affecting the value of assets or hindering investment opportunities. The perceived worth in these cases is a composite of the actual financial standing and the public's appraisal of that standing.

The practical significance of understanding this relationship lies in comprehending the interplay between tangible financial realities and subjective public assessments. Individuals and organizations managing assets should be cognizant of the potential for public perception to influence their financial success. Strategic communication, public relations, and a strong reputation management plan can effectively counteract negative perceptions and enhance public confidence. Recognizing the impact of public perception on financial standing provides tools for mitigating risks and capitalizing on opportunities. Ultimately, accurate estimations of financial value, including the potentially significant contribution of public perception, require nuanced considerations of both tangible and intangible factors.

8. Career Impact

Career trajectory significantly influences Paul Guilfoyle's net worth. The nature of employment, earning potential, and career progression directly impact the accumulation of wealth. High-earning professions often correlate with substantial asset accumulation over time, leading to a higher net worth. Conversely, lower-paying or less stable careers may result in limited wealth accumulation.

Specific career choices and achievements can substantially impact asset growth. For instance, a career in high-demand fields like technology or finance often yields substantial compensation packages. Successful entrepreneurial ventures can generate substantial wealth and potentially result in significant net worth increases, depending on the venture's success. Alternatively, a consistent career progression, marked by promotions and increased responsibilities, usually translates into higher income and potentially more extensive investment opportunities, consequently impacting net worth positively. Strategic investments and financial planning correlated with career advancements are vital to bolstering net worth.

The practical significance of understanding the connection between career impact and net worth is multifaceted. Individuals can use this awareness to strategically plan their careers in alignment with their financial goals. Career choices that align with high-earning potential or opportunities for entrepreneurial endeavors can be consciously prioritized. Investment strategies, savings plans, and overall financial decisions are all intertwined with career considerations. In short, a conscious understanding of how career choices and achievements translate into financial outcomes allows for better-informed decisions, contributing to long-term financial security and a growing net worth. An individual's career path is a cornerstone for constructing and maintaining a strong financial foundation. This awareness empowers individuals to navigate career decisions and pursue financial objectives effectively.

Frequently Asked Questions about Paul Guilfoyle's Net Worth

This section addresses common inquiries regarding Paul Guilfoyle's financial standing, providing accurate and informative responses based on publicly available information. Determining precise net worth figures is often challenging due to the private nature of such information.

Question 1: What is the precise net worth of Paul Guilfoyle?

Precise figures for Paul Guilfoyle's net worth are not publicly available. Estimation of net worth necessitates access to private financial records, which are typically not accessible to the public.

Question 2: How is net worth typically calculated?

Net worth is calculated by subtracting total liabilities from total assets. Assets encompass various holdings like real estate, investments, and personal possessions. Liabilities represent financial obligations such as outstanding debts or loans.

Question 3: What factors influence the calculation of net worth?

Numerous factors influence net worth estimation. These include market conditions, investment performance, real estate values, and any outstanding debts. Changes in these factors directly affect the calculated net worth. Appraisals and estimations of various asset types are involved.

Question 4: Where can one find reliable information about net worth?

Reliable information regarding net worth, if available, may originate from financial publications, news reports, or biographies. Publicly available information is often limited and may only present an overview or estimate.

Question 5: Why is determining net worth important?

Understanding an individual's financial standing provides context for various analyses, including career success, stability, and potential influence within specific spheres. This information is relevant for business, personal, and investment decisions. Public understanding of financial standing can be influential.

Question 6: How does public perception influence estimates of Paul Guilfoyle's net worth?

Public perception, shaped by media portrayals or professional successes, can impact the perceived value of Paul Guilfoyle's assets or investments, even if not directly reflected in actual market values. The interplay of public perception and actual financial standing creates complexities in estimating net worth.

In summary, while precise figures remain elusive, understanding the various factors affecting net worth calculation, along with the complexities of estimating it, is crucial for evaluating financial standing accurately.

Moving forward, a detailed examination of Paul Guilfoyle's career and public activities may provide insights into potential financial trends, but precise valuations remain difficult to ascertain.

Tips for Understanding Net Worth

Assessing an individual's net worth involves analyzing various factors, including assets, liabilities, income sources, and financial history. This section offers practical guidance for comprehending these aspects.

Tip 1: Categorize Assets Accurately. Differentiating between various asset types is crucial. Tangible assets, such as real estate or vehicles, have inherent value but require separate valuation methods compared to intangible assets like stocks or intellectual property. Precise categorization ensures accurate calculation of overall net worth.

Tip 2: Account for All Liabilities. A comprehensive analysis of net worth necessitates including all liabilities, not just prominent ones. Unpaid bills, outstanding loans, and any contingent liabilities should be factored into the calculations to derive an accurate picture of the financial position. Failure to account for these obligations may significantly misrepresent the true financial status.

Tip 3: Examine Income Sources Diversification. Dependency on a single income source introduces risk. Analyzing diverse income streams, including employment, investments, and entrepreneurial endeavors, provides a more stable financial picture. Diversified income streams contribute to long-term financial stability and robustness.

Tip 4: Evaluate Financial History for Patterns. A thorough examination of financial history reveals patterns in income, spending, and investment habits. Identifying these patterns helps anticipate future trends and make informed financial decisions for optimal wealth management and potentially increased net worth over time.

Tip 5: Utilize Multiple Valuation Methods for Assets. Employing various valuation approaches when assessing assets provides a more comprehensive valuation. Using multiple methods helps to minimize potential biases and inaccuracies in net worth calculations, promoting more reliable estimates.

Tip 6: Understand Public Perception's Influence. Public perception, though not directly impacting net worth, influences the perceived value of assets and investment opportunities. Awareness of this aspect allows for a more holistic understanding of financial standing and potential impacts on opportunities.

Tip 7: Consider Career Progression and Earning Potential. Career trajectory significantly influences net worth. High-earning potential and career progression can contribute to greater wealth accumulation and potentially a higher net worth. Understanding these correlations aids in informed career and financial planning.

By carefully following these tips, individuals and analysts can gain a clearer understanding of the factors impacting net worth and make more informed financial decisions. This in turn can facilitate a more realistic and comprehensive evaluation.

Moving forward, continued research and detailed analysis of publicly accessible information, if available, can contribute to a more nuanced understanding of financial situations and potentially predict future trends.

Conclusion

This exploration of Paul Guilfoyle's net worth highlights the multifaceted nature of such assessments. A complete understanding necessitates a thorough examination of assets, liabilities, income sources, financial history, valuation methods, public perception, and career impact. The various components involvedreal estate holdings, investment portfolios, debt obligations, and income streamscollectively shape the overall financial picture. The analysis underscores that precise figures are often elusive, as access to private financial data is limited. Furthermore, the impact of public perception and career trajectory on the perceived value of assets and investments adds complexity to any estimate.

Ultimately, comprehending Paul Guilfoyle's financial situation requires acknowledging the interplay of tangible assets and intangible factors. The absence of definitive, publicly available data necessitates a nuanced understanding of the limitations inherent in estimations. Future research, though constrained by the scarcity of public information, could potentially yield further insights into the dynamics shaping Paul Guilfoyle's financial position. Moreover, the principles outlined in this analysis are broadly applicable to understanding net worth in other contexts, offering a framework for evaluating the interplay of financial factors.

- Josh Allen Old Tweets

- 1534693 Piece Female Characters Deserve Attention

- 1230857 Tyler Perry Net Worth Age Height House Wife Son

- Kristy Mcnichol

- Thay Ksada

- 1470855 Zack Lugos Biography Age Height Net Worth Girlfriend Brother

- Tiffany Link Earrings

- La Freeway Protest

- Oleksandr Zinchenko