In today's fast-paced world, college students are constantly seeking ways to supplement their income while managing their academic responsibilities. With tuition costs rising and the demand for financial independence increasing, finding a reliable source of passive income can be a game-changer for students. The concept of passive income, which involves earning money with minimal ongoing effort, is particularly appealing to those juggling classes, extracurricular activities, and part-time jobs. Fortunately, the digital age offers numerous opportunities for students to explore passive income streams that align with their skills and interests.

As college students embark on the journey to financial freedom, it's crucial to understand the various passive income avenues available and how to maximize their potential. From investing in stocks and real estate to creating digital products and content, students can leverage their unique talents and knowledge to generate income that continues to flow even when they focus on their studies. This comprehensive guide aims to provide students with a roadmap to navigate the world of passive income, offering practical tips, real-life examples, and expert insights to help them make informed decisions and achieve financial stability.

By embracing the principles of passive income, college students can learn valuable financial skills, build a foundation for future wealth, and alleviate the stress of financial constraints. This guide will delve into various strategies, explore potential challenges, and offer solutions to help students create a sustainable passive income stream. Whether you're a full-time student looking to reduce reliance on student loans or simply interested in building a side income, this article will equip you with the knowledge and tools needed to succeed in the world of passive income.

Table of Contents

- Understanding Passive Income

- Why Passive Income is Important for College Students

- Investment Opportunities

- Creating Digital Products

- Affiliate Marketing

- Blogging and Content Creation

- Online Courses and Tutoring

- Real Estate Investment

- Stock Market Investment

- Peer-to-Peer Lending

- Print on Demand

- Renting Assets

- Dividend Investing

- Networking and Collaborations

- Frequently Asked Questions

- Conclusion

Understanding Passive Income

Passive income refers to earnings derived from a rental property, limited partnership, or other enterprise in which a person is not actively involved. Unlike active income, where individuals trade time for money through employment or services, passive income continues to generate revenue with minimal effort or direct involvement. This financial model is particularly attractive as it allows for income diversification and long-term wealth accumulation without the constant need for active engagement.

The essence of passive income is that it provides financial stability and security over time, allowing individuals to focus on other pursuits. For college students, this means the ability to concentrate on academic goals while simultaneously building a financial cushion for future endeavors. Understanding the mechanics of passive income is crucial as it enables students to explore various income streams that align with their skills and interests while offering the potential for sustainable earnings.

Why Passive Income is Important for College Students

Passive income holds significant importance for college students due to several factors. Firstly, it provides a supplementary income source that can help alleviate financial burdens such as tuition fees, accommodation costs, and daily expenses. With rising education costs, having a steady stream of passive income can significantly ease the financial pressures students face, allowing them to focus more on their studies and personal development.

Secondly, passive income fosters financial literacy and independence among students. By exploring different income-generating opportunities, students gain valuable insights into financial management, investment strategies, and entrepreneurship. This knowledge serves as a foundation for future financial success, empowering students to make informed decisions and build wealth over time.

Moreover, passive income allows students to diversify their income streams, reducing reliance on traditional part-time jobs. This diversification not only provides financial security but also opens doors to new opportunities and experiences. Students can leverage their creativity, skills, and knowledge to explore various avenues, from digital products and content creation to investment opportunities, ultimately paving the way for a more fulfilling and prosperous future.

Investment Opportunities

Investment opportunities provide college students with a pathway to passive income through various financial instruments and assets. Investing allows students to grow their wealth over time by leveraging the power of compounding and market appreciation. There are several investment options that students can explore, each offering unique benefits and risks.

Mutual Funds and ETFs

Mutual funds and exchange-traded funds (ETFs) are popular investment choices for students due to their diversification and professional management. These funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, and other securities. By investing in mutual funds or ETFs, students gain exposure to a wide range of assets, reducing the risk associated with individual stock investments.

Mutual funds and ETFs offer the advantage of professional management, as fund managers actively monitor and adjust the portfolio to optimize returns. This makes them an attractive option for students who may not have the time or expertise to manage their investments actively. Additionally, these funds provide liquidity, allowing students to buy or sell their shares on the stock exchange at any time.

Real Estate Crowdfunding

Real estate crowdfunding platforms have gained popularity among college students seeking passive income opportunities. These platforms allow individuals to invest in real estate properties with relatively small amounts of capital, making real estate investment accessible to students. By pooling funds with other investors, students can participate in real estate projects and earn passive income through rental yields and property appreciation.

Real estate crowdfunding offers the advantage of diversification, as students can invest in various properties across different locations and sectors. This diversification helps mitigate risks and enhances the potential for returns. Additionally, students can benefit from the expertise of real estate professionals who manage the properties and oversee operations, making it a hands-off investment option.

Dividend Stocks

Dividend stocks are another attractive investment option for college students seeking passive income. These stocks belong to companies that regularly distribute a portion of their profits to shareholders in the form of dividends. By investing in dividend-paying stocks, students can earn a steady stream of income while benefiting from potential capital appreciation.

Dividend stocks are known for their stability and reliability, making them a popular choice for income-focused investors. Students can reinvest the dividends to compound their returns over time, further enhancing their passive income. It's important for students to conduct thorough research and select dividend stocks with a track record of consistent payouts and strong financial performance.

Creating Digital Products

Creating digital products is a lucrative avenue for college students to generate passive income. This approach allows students to leverage their skills, knowledge, and creativity to develop products that can be sold online, reaching a global audience. Digital products offer the advantage of scalability, as they can be created once and sold repeatedly without significant additional effort.

E-books

Writing and publishing e-books is a popular option for students who have expertise in a particular subject or a passion for writing. E-books can cover a wide range of topics, from academic subjects and self-help to fiction and memoirs. Once published, e-books can be sold on platforms like Amazon Kindle, Apple Books, and other online marketplaces, generating passive income through royalties.

Students can leverage their academic knowledge, research skills, and personal experiences to create valuable content that resonates with readers. E-books offer the advantage of low production costs, as they can be created and distributed digitally without the need for physical printing. Additionally, students can use social media and online marketing strategies to promote their e-books and reach a wider audience.

Online Courses

Online courses present an excellent opportunity for students to share their expertise and knowledge with others while earning passive income. Students can create and sell courses on topics they are passionate about or have specialized knowledge in, such as coding, graphic design, language learning, or personal development. Platforms like Udemy, Teachable, and Coursera provide a user-friendly environment for course creation and distribution.

Creating online courses requires an initial investment of time and effort to develop high-quality content, including video lectures, quizzes, and assignments. However, once the course is published, it can generate passive income as students enroll and complete the course at their own pace. Students can also benefit from course reviews and feedback, helping them improve and expand their course offerings over time.

Affiliate Marketing

Affiliate marketing is a popular passive income strategy that allows college students to earn commissions by promoting products or services offered by other companies. Students can join affiliate programs and promote products through their blogs, social media channels, websites, or email newsletters. When someone makes a purchase through the affiliate link, the student earns a commission on the sale.

Affiliate marketing offers the advantage of flexibility, as students can choose products that align with their interests and target audience. This strategy requires minimal upfront investment, making it accessible to students with limited financial resources. Additionally, students can leverage their online presence and influence to reach a broader audience and increase their earning potential.

To succeed in affiliate marketing, students should focus on building trust and credibility with their audience by providing genuine and valuable recommendations. It's important to disclose affiliate relationships transparently and prioritize the needs and preferences of the audience. By consistently delivering high-quality content and engaging with followers, students can create a sustainable passive income stream through affiliate marketing.

Blogging and Content Creation

Blogging and content creation offer college students a platform to express their creativity, share their insights, and earn passive income. By creating a blog or YouTube channel, students can produce engaging content on topics they are passionate about, such as travel, lifestyle, technology, or personal development. As the blog or channel gains traction, students can monetize their content through various channels.

Monetizing Your Blog

Monetizing a blog involves generating income through advertising, sponsored posts, affiliate marketing, and selling digital products or services. Students can join ad networks like Google AdSense or work directly with brands to display ads on their blogs. Sponsored posts involve collaborating with companies to create content that promotes their products or services in exchange for compensation.

Affiliate marketing can also be integrated into blog content, allowing students to earn commissions by recommending products or services to their readers. Additionally, students can create and sell digital products such as e-books, online courses, or printables related to their blog niche, providing value to their audience while generating passive income.

Growing Your YouTube Channel

Creating a YouTube channel is another avenue for content creators to earn passive income. By producing engaging and informative videos, students can attract a loyal audience and monetize their channel through ads, sponsorships, and merchandise sales. YouTube's Partner Program allows creators to earn revenue from ads displayed on their videos, providing a steady stream of passive income as the channel grows.

To succeed on YouTube, students should focus on creating high-quality content that resonates with their target audience and optimizing their videos for search and discoverability. Consistency, creativity, and audience engagement are key factors in building a successful YouTube channel. As the channel gains popularity, students can explore additional income streams such as brand partnerships and merchandise sales.

Online Courses and Tutoring

Online courses and tutoring provide college students with an opportunity to share their knowledge and expertise while earning passive income. By creating and selling online courses or offering tutoring services, students can reach a global audience and provide valuable educational content to learners.

Developing Online Courses

Developing online courses involves creating structured learning materials, including video lectures, quizzes, assignments, and supplementary resources. Students can leverage their academic knowledge, skills, and experiences to design courses that cater to the needs of their target audience. Platforms like Udemy, Teachable, and Skillshare offer tools and resources for course creation and distribution.

Once the course is published, students can earn passive income as learners enroll and complete the course at their own pace. It's important to continually update and improve the course content based on feedback and industry trends to maintain its relevance and appeal. Additionally, students can use marketing strategies such as social media promotion and email campaigns to expand their course reach and attract more learners.

Tutoring Services

Offering tutoring services is another way for college students to earn passive income while helping others succeed academically. Students can provide one-on-one or group tutoring sessions on subjects they excel in, such as math, science, languages, or standardized test preparation. Online platforms like Chegg Tutors, Tutor.com, and Wyzant offer opportunities for students to connect with learners seeking tutoring assistance.

While tutoring requires some active involvement, students can leverage technology to automate scheduling, billing, and communication processes, allowing them to focus on delivering high-quality educational support. By building a reputation as a knowledgeable and reliable tutor, students can attract a steady stream of clients and earn a consistent passive income over time.

Real Estate Investment

Real estate investment offers college students a tangible and potentially lucrative opportunity to generate passive income. While traditional real estate investment may require significant capital and expertise, there are alternative options that make real estate accessible to students with limited resources.

Real Estate Crowdfunding

Real estate crowdfunding platforms allow students to invest in real estate properties with relatively small amounts of capital. These platforms pool funds from multiple investors to purchase and manage properties, providing students with an opportunity to earn passive income through rental yields and property appreciation.

Real estate crowdfunding offers diversification, as students can invest in various properties across different locations and sectors. This diversification helps mitigate risks and enhances the potential for returns. Additionally, students benefit from the expertise of real estate professionals who manage the properties and oversee operations, making it a hands-off investment option.

REITs (Real Estate Investment Trusts)

Real Estate Investment Trusts (REITs) provide another avenue for students to invest in real estate without the need to buy and manage properties directly. REITs are companies that own and operate income-generating real estate assets, such as commercial properties, residential complexes, and infrastructure projects. By purchasing shares in a REIT, students can earn passive income through dividends and potential capital appreciation.

REITs offer the advantage of liquidity, as they are traded on major stock exchanges like regular stocks. This allows students to buy and sell shares easily, providing flexibility and access to a diversified real estate portfolio. Additionally, REITs are managed by professionals, reducing the need for students to have extensive knowledge or experience in real estate management.

Stock Market Investment

Stock market investment is a popular choice for college students seeking passive income through capital appreciation and dividends. Investing in stocks allows students to buy shares of publicly traded companies and participate in their growth and success. While stock market investment carries risks, it also offers the potential for significant returns over the long term.

Index Funds and ETFs

Index funds and exchange-traded funds (ETFs) are investment vehicles that track a specific market index, such as the S&P 500 or the NASDAQ. These funds offer diversification by investing in a broad range of stocks, reducing the risk associated with individual stock investments. Index funds and ETFs are managed passively, meaning they aim to replicate the performance of the underlying index rather than outperform it.

For college students, index funds and ETFs provide a convenient and low-cost way to invest in the stock market. These funds offer the advantage of professional management, as they are overseen by experienced fund managers. Additionally, index funds and ETFs have lower expense ratios compared to actively managed funds, allowing students to keep more of their returns.

Dividend Stocks

Dividend stocks are another attractive option for students seeking passive income through stock market investment. These stocks belong to companies that regularly distribute a portion of their profits to shareholders in the form of dividends. By investing in dividend-paying stocks, students can earn a steady stream of income while benefiting from potential capital appreciation.

Dividend stocks are known for their stability and reliability, making them a popular choice for income-focused investors. Students can reinvest the dividends to compound their returns over time, further enhancing their passive income. It's important for students to conduct thorough research and select dividend stocks with a track record of consistent payouts and strong financial performance.

Peer-to-Peer Lending

Peer-to-peer lending is a modern financial model that allows college students to earn passive income by lending money directly to individuals or businesses through online platforms. These platforms connect borrowers with lenders, eliminating the need for traditional financial institutions like banks. By participating in peer-to-peer lending, students can earn interest on their loans, generating a steady stream of passive income.

Peer-to-peer lending offers the advantage of diversification, as students can lend small amounts to multiple borrowers, spreading the risk across a portfolio of loans. Additionally, students can choose the level of risk they are comfortable with, as platforms categorize loans based on the borrower's creditworthiness and risk profile. This flexibility allows students to tailor their lending strategy to their financial goals and risk tolerance.

It's important for students to conduct thorough research and due diligence before participating in peer-to-peer lending. Understanding the platform's terms, borrower profiles, and potential risks is crucial to making informed lending decisions. By carefully selecting loans and diversifying their portfolio, students can create a sustainable passive income stream through peer-to-peer lending.

Print on Demand

Print on demand is a business model that allows college students to create and sell custom-designed products without the need for inventory or upfront investment. This approach involves partnering with a print-on-demand service provider that handles printing, packaging, and shipping on behalf of the student. By designing unique products such as t-shirts, mugs, posters, and more, students can earn passive income through sales.

Print on demand offers the advantage of low risk and low startup costs, as students only pay for products once they are sold. This eliminates the need for inventory management and reduces the financial burden associated with traditional retail models. Additionally, students can leverage their creativity and design skills to create products that resonate with their target audience and reflect their personal brand.

To succeed in print on demand, students should focus on creating high-quality designs and marketing their products effectively. Utilizing social media, online marketplaces, and e-commerce platforms can help students reach a wider audience and increase sales. By consistently updating their product offerings and engaging with customers, students can build a successful print-on-demand business and generate passive income.

Renting Assets

Renting assets is a practical way for college students to generate passive income by leveraging their existing resources. By renting out items they own, such as vehicles, electronics, or equipment, students can earn additional income without significant upfront investment. This approach allows students to monetize assets that are not in constant use, providing a steady stream of passive income.

Platforms like Turo, Airbnb, and RentMyItems offer opportunities for students to rent out their cars, accommodations, and other assets to individuals seeking temporary use. These platforms provide a convenient and secure environment for facilitating transactions, handling payments, and managing bookings. By utilizing these platforms, students can reach a broader audience and maximize their rental income potential.

It's important for students to conduct thorough research and ensure their assets are well-maintained and insured before renting them out. Setting competitive pricing, providing excellent customer service, and maintaining open communication with renters are key factors in building a successful rental business. By effectively managing their assets and rental agreements, students can create a reliable passive income stream through renting.

Dividend Investing

Dividend investing is a strategy that involves purchasing stocks of companies that regularly distribute a portion of their profits to shareholders in the form of dividends. This approach allows college students to earn a steady stream of passive income while benefiting from potential capital appreciation. Dividend investing is known for its stability and reliability, making it an attractive option for income-focused investors.

To succeed in dividend investing, students should focus on selecting stocks with a track record of consistent payouts and strong financial performance. Conducting thorough research and analysis of the company's financial health, dividend history, and growth prospects is crucial to making informed investment decisions. Additionally, students can reinvest the dividends to compound their returns over time, further enhancing their passive income.

Dividend investing offers the advantage of flexibility, as students can tailor their investment strategy to their financial goals and risk tolerance. By diversifying their dividend portfolio across different sectors and industries, students can reduce risk and enhance the potential for returns. This approach allows students to create a sustainable passive income stream and build a foundation for future wealth.

Networking and Collaborations

Networking and collaborations provide college students with valuable opportunities to expand their reach, build relationships, and generate passive income. By connecting with like-minded individuals, industry professionals, and potential partners, students can leverage their skills and expertise to create mutually beneficial collaborations that enhance their income potential.

Networking involves actively engaging with individuals and organizations within a particular industry or community. Students can attend events, join online forums, and participate in workshops to build relationships and gain insights into industry trends and opportunities. By establishing a strong network, students can access valuable resources, mentorship, and collaboration prospects that contribute to their passive income goals.

Collaborations involve working together with others to achieve common objectives. Students can collaborate with peers, influencers, and businesses to create joint projects, co-authored content, or shared ventures. These collaborations allow students to combine resources, skills, and audiences, resulting in increased exposure and financial rewards. By fostering meaningful partnerships, students can create a sustainable passive income stream and achieve long-term success.

Frequently Asked Questions

1. What is passive income, and how does it work?

Passive income is earnings derived from activities in which an individual is not actively involved. It involves generating revenue with minimal ongoing effort, allowing individuals to earn money while focusing on other pursuits.

2. Why is passive income important for college students?

Passive income provides college students with financial stability, independence, and the opportunity to focus on academic and personal goals. It helps alleviate financial burdens and fosters financial literacy and wealth-building skills.

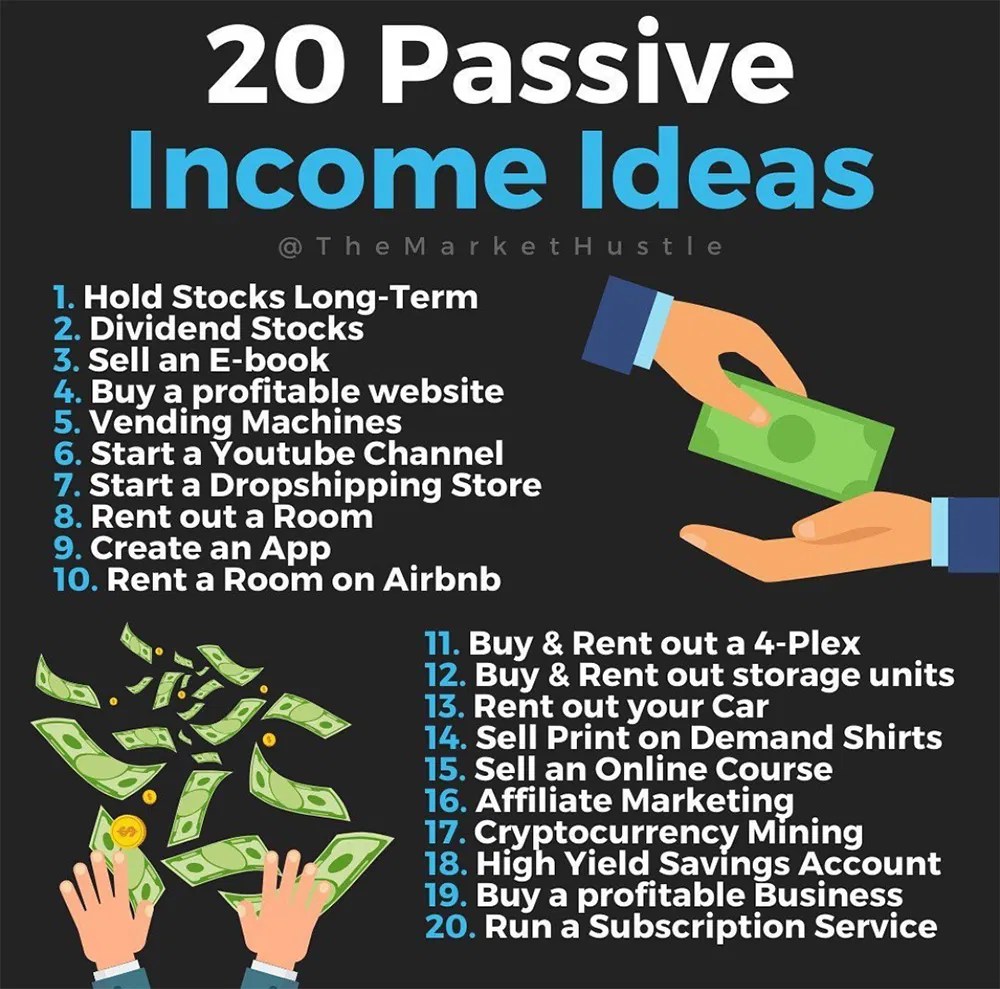

3. What are some passive income ideas for college students?

College students can explore various passive income ideas, including investing in stocks, real estate, or mutual funds, creating digital products, affiliate marketing, blogging, and renting assets.

4. How can students start investing in the stock market?

Students can start investing in the stock market by opening a brokerage account, researching investment options such as index funds, ETFs, and dividend stocks, and setting clear financial goals and strategies.

5. What are the benefits of creating digital products?

Creating digital products allows students to leverage their skills and creativity to earn passive income. It offers scalability, low production costs, and the potential to reach a global audience through online platforms.

6. How can students succeed in affiliate marketing?

To succeed in affiliate marketing, students should focus on building trust with their audience, providing genuine recommendations, and choosing affiliate products that align with their interests and target audience.

Conclusion

In conclusion, the journey to understanding how to make passive income as a college student is both exciting and rewarding. With the array of opportunities available, from investment options like stocks and real estate to creating digital products and engaging in affiliate marketing, students can find avenues that align with their interests and skills. Embracing passive income not only provides financial stability but also instills valuable life skills, offering a foundation for future success.

As students explore these passive income strategies, it's important to approach each opportunity with careful consideration, thorough research, and a proactive mindset. By leveraging their unique talents, networking with peers and professionals, and continuously learning, students can navigate the world of passive income with confidence and optimism. This journey not only enhances their financial well-being but also empowers them to achieve their academic and personal goals with greater ease and flexibility.

Ultimately, the pursuit of passive income offers college students the chance to redefine their financial future, alleviate financial stress, and pave the way for a more prosperous and fulfilling life. By taking the first step today, students can unlock their potential and embark on a path to long-term financial prosperity.

You Might Also Like

Trimetilaminuria: Cómo Se Contagia Y Su Impacto En La Vida CotidianaMastering Google Docs: How To Make A Picture A Background

Unraveling The Sentiment: Why Some Say "Niners Suck"

Unraveling The SunPass Toll Bill Scam: A Comprehensive Guide

The Remarkable Loyalty Of Labradors: Unveiling Their Devotion And Companionship

Article Recommendations

- Adhd And Gaming

- What Does Inexplicable Mean

- Gold Piercing Helix

- Usain Bolt Net Worth

- Two Front Door House

- Smallest Trees In The World.htm

- Shield Recipe For Minecraft

- Are Egg Cartons Recyclable

- Hayward Fault In California

- Best Exercise Classes